tax on unrealized gains uk

Unrealized gains or losses are the gains or losses that the seller expects to earn when the invoice is settled but the customer has failed to pay the. Add this amount to your taxable income.

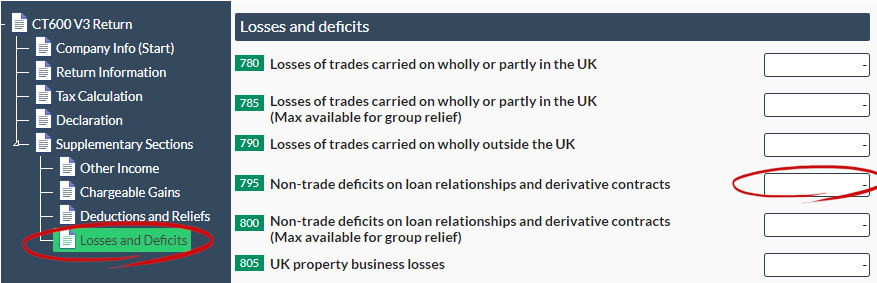

Reporting Forex Gains And Losses For Corporation Tax Easy Digital Filing

In contrast to the tax treatment the accounting treatment set out in Statement of Standard Accounting Practice 20 SSAP20 was relatively straightforward with exchange gains or losses.

. Deduct your tax-free allowance from your total taxable gains. A tax on unrealized gains is clearly not in compliance with Article I Section 9 nor is it covered under the 16th Amendment which the Supreme Court explicitly ruled in Eisner v. Last reviewed - 27 July 2022.

Its important to note that while theres no current tax on unrealized capital gains that may not always be the case for some investors. To increase their effective tax rate. Below are one economists estimates of what the top 10 wealthiest.

Work out your total taxable gains. How are capital gains taxed in UK. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum.

Unrealized gains are not taxed by the IRS. In the United States unrealized gains are not taxable until they have been sold and unrealized losses do not have a tax benefit until theyve been realized. The Ministry of Finance published a draft Amendment to the Act on Personal Income Tax further the PIT Corporate Income Tax further the CIT and the Tax Code.

This means you dont have to report them on your annual tax return. Unrealized gains are not generally taxed. Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation.

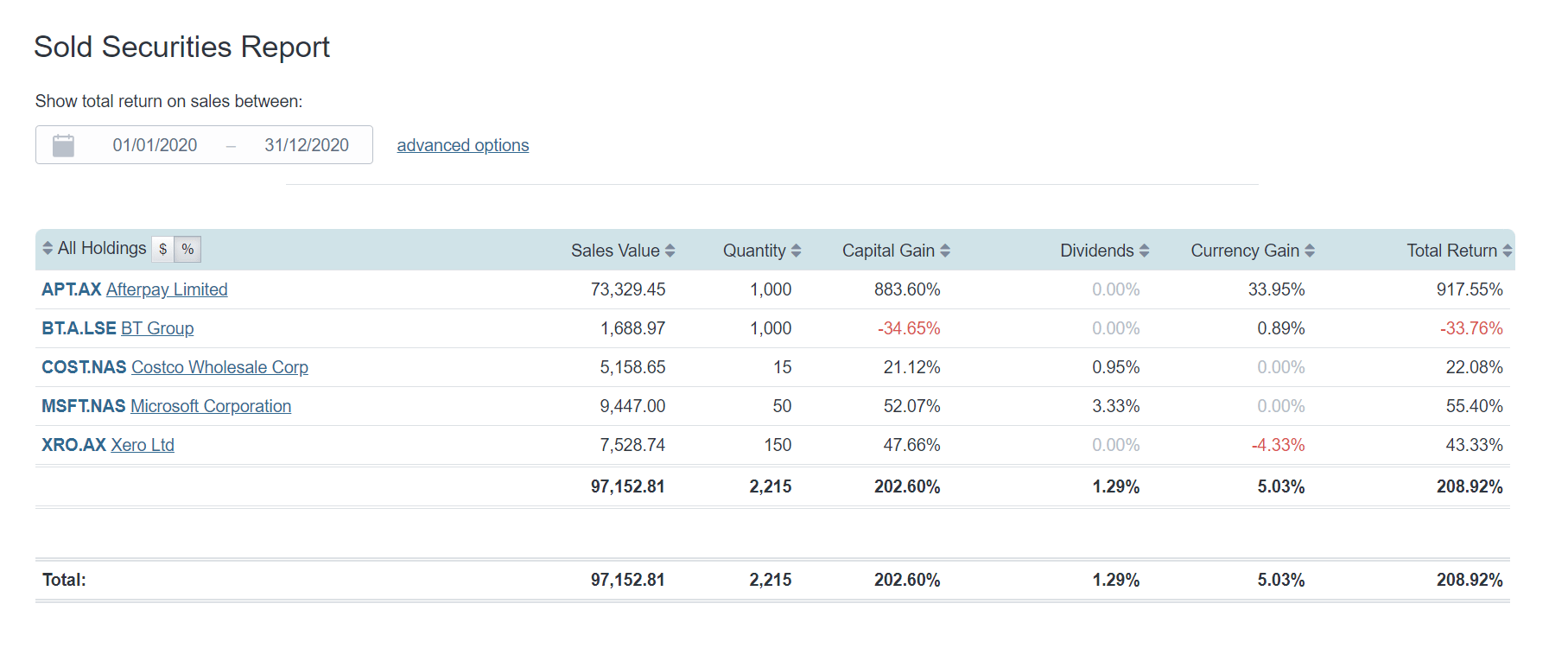

Unrealised gainslosses are the difference between the market value at the closing balance sheet date and the market value at the opening balance sheet date in cases where there have been. You dont incur a tax liability until you sell your investment and realize the gain. For example if you were.

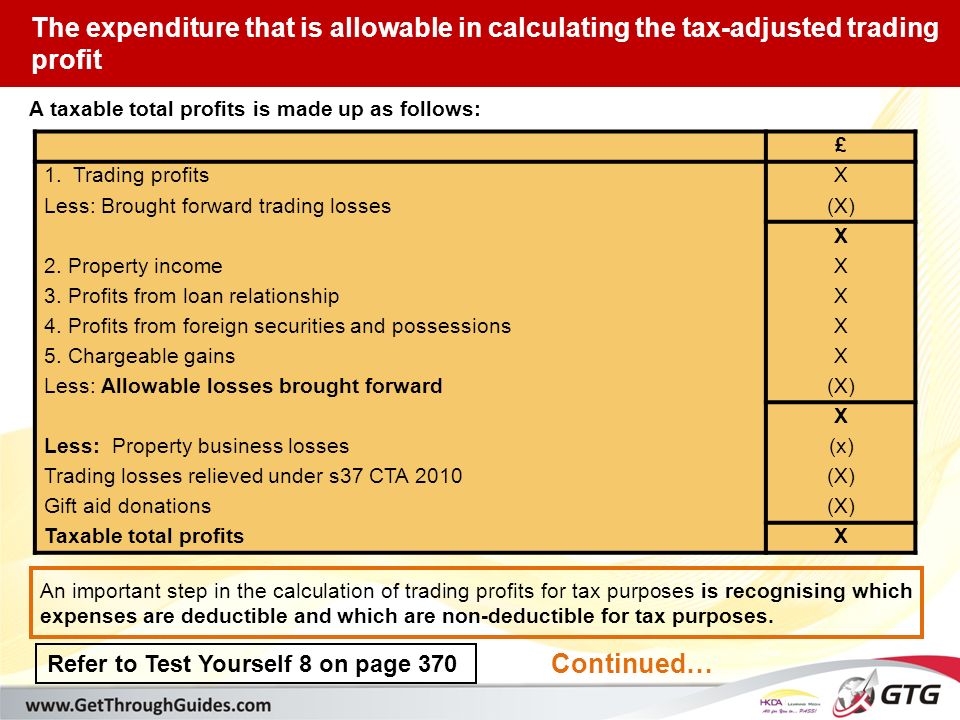

Postby pawncob Tue Jul 22 2014 1024 pm. You show the shares at the current market value and show a notional profitloss on the. A UK resident company is taxed on its worldwide total profits.

There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings. The unrealized FX gainslosses that are not currently taxable will be taxable when the liability is settled. The competition is looking to track and report any transaction over 600 trying to normalize taxes on unrealized gains and doesnt understand that companies will raise prices if.

Tax unrealized capital gains at death for unrealized gains above 1 million 2 million for joint filers plus current law capital gains exclusion of 250000500000 for primary. Is unrealized gain a temporary difference. Billionaires to pay taxes annually on unrealized capital gains has garnered wide support by.

When President Joe Biden introduced his. There will be a corresponding debtor relationship where the debtor to the creditor loan relationship is within the charge to UK corporation tax and is required to bring into. Capital gains are only taxed if they are realized which means.

Taxes on unrealised Gains Losses. Tax Implications of Unrealized Gains and Losses. This also means that.

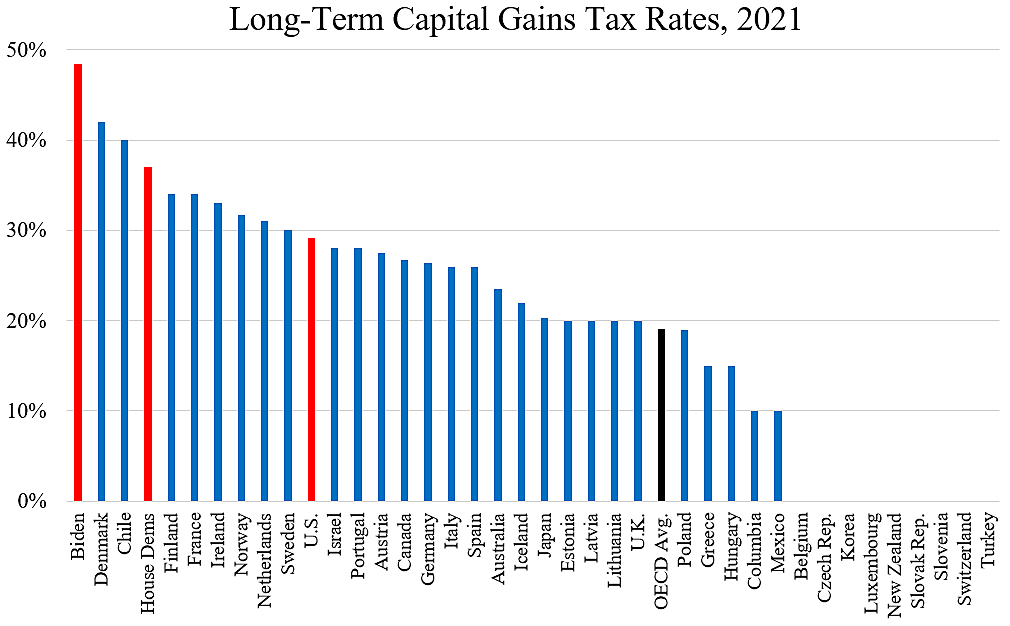

However not all realized gains are taxed at the same rate. By Georg Grassmueck President Bidens proposal to require roughly 700 US. Total profits are the aggregate of i the.

Corporate - Income determination.

Adjustments Of Foreign Capital Gains And Losses For The Foreign Tax Credit

Capital Gains Taxes And The Democrats Cato At Liberty Blog

The Coming Tax On Unrealized Capital Gains Youtube

The Unintended Consequences Of Taxing Unrealized Capital Gains

China Taxation Of Cross Border M A Kpmg Global

What Is Capital Gains Tax In The Uk

F6 Taxation Uk Section A The Uk Tax System Section B Income Tax Liabilities Section C Chargeable Gains Section D Corporation Tax Liabilities Section Ppt Download

Capital Gain Definition Types Corporate Tax Rates Example

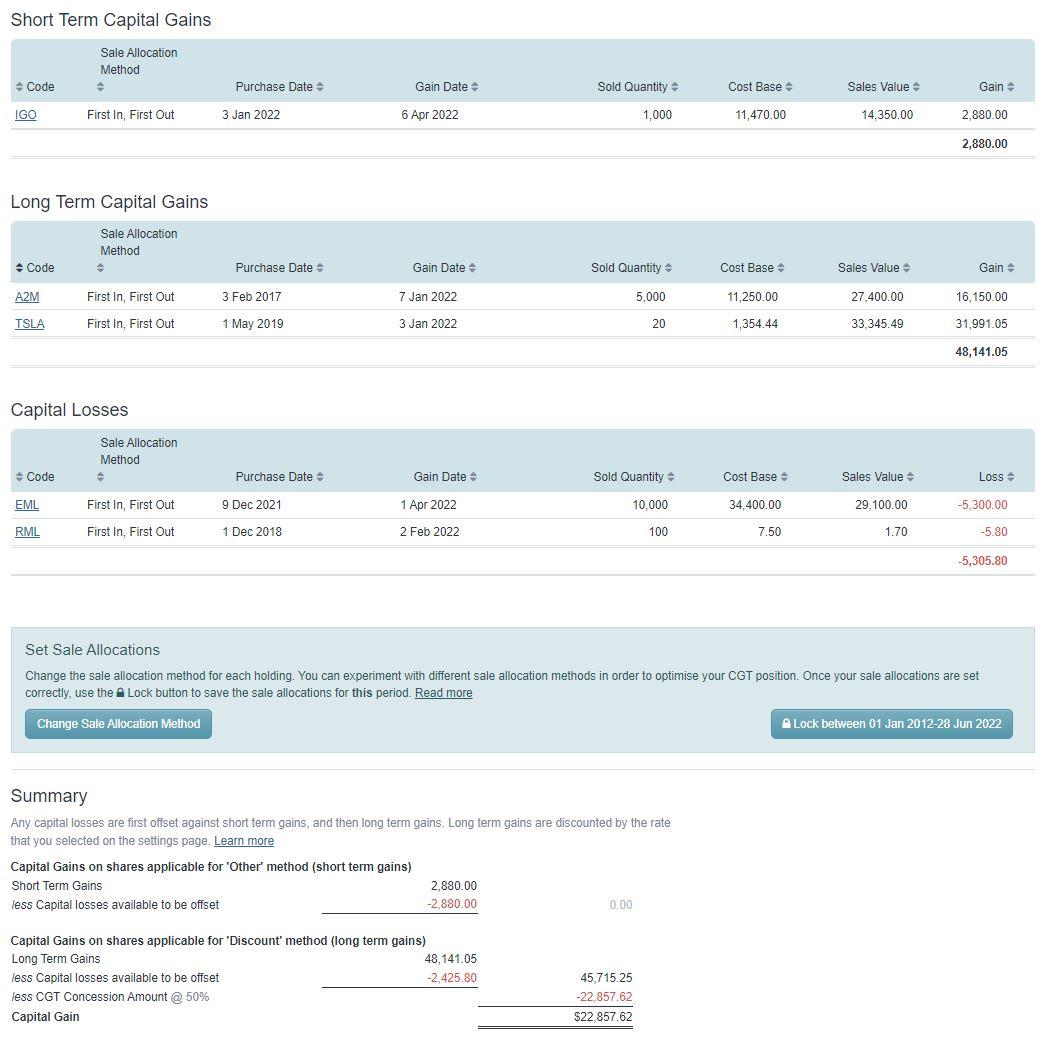

Capital Gains Tax Cgt Calculator For Australian Investors

Taxing Non Residents On Uk Property Gains The Rules For Funds

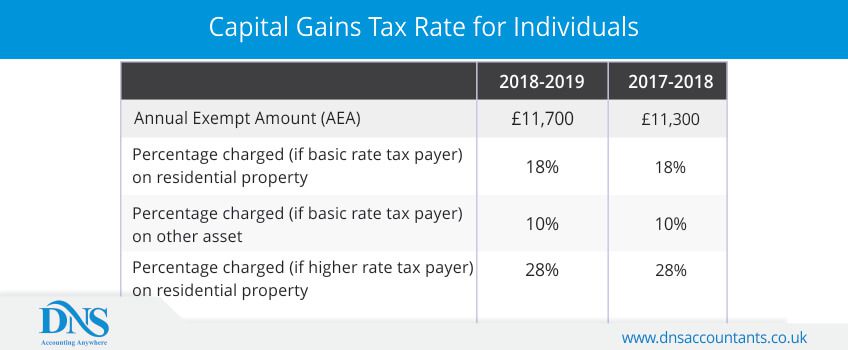

Capital Gains Tax Calculator How To Calculate Dns Accountants

Taxation Of Capital Gains For Individuals And Companies Taxation

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World